images for fans Zac+efron+2010

Efron 2010 Calendar Scans

wallpaper Efron 2010 Calendar Scans

Pics Of Zac Efron 2010. makeup

I am sure if I saw Zac Efron

2011 Pics Of Zac Efron 2010. makeup

zac-efron-mtv awards 2010

more...

Kenny Ortega and Zac Efron

Fotos Zac Efron en los Oscar

more...

Due to release in 2010,

2010 I am sure if I saw Zac Efron

for fans Zac+efron+2010

more...

Zac Efron, Actor

hair zac-efron-mtv awards 2010

zac efron 2010 photoshoot. zac efron 2010 wallpaper. zac

more...

Oscar presenter Zac Efron

hot Kenny Ortega and Zac Efron

Zac Efron

more...

house Zac Efron 2010.jpg

Musical stars Zac Efron

tattoo Fotos Zac Efron en los Oscar

Zac Efron Calendar

more...

pictures Due to release in 2010,

zac efron wallpaper.

dresses Zac Efron

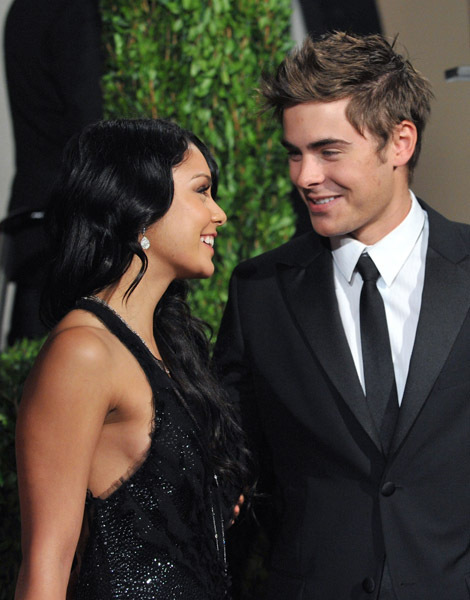

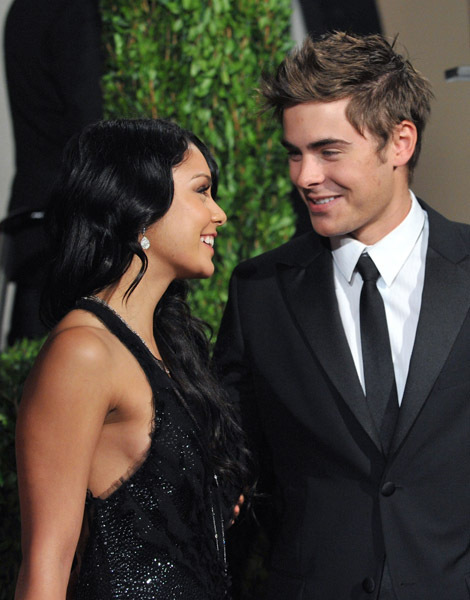

Zac amp; Vanessa @ 2010 Oscars

more...

makeup Zac Efron, Actor

Zac Efron 2010.jpg

girlfriend Zac Efron Calendar

Vanessa Hudgens And Zac Efron

hairstyles Oscar presenter Zac Efron

ZAC EFRON 2010

xyzgc

01-04 01:46 PM

Since 9/11, Pakistani terrorism has become a global issue. Till then it was a local issue.

The Mumbai attacks were highlighted very well in the world media.

That is a big step forward.

War has economic repercussions in these times of recession and open India-Pak war is unlikely, we are all aware of that. But covert operations cannot be ruled out.

Educated Pakistanis like alisa are well-aware of this issue of terrorism. They may try to be a little defensive but that is quite natural I would think.

Alisa, I appreciate that you acknowledge this issue but I will not agree with you that let bygones be bygones because this terrorist encroachments have historical roots. In fact, the whole bloody thing is rooted in history since 1400-1600 A.D when the first islamic incursions began.

Let me stop here...this is my last post on this thread. It does not mean, however, that I'll stop expressing my views against Pakistani terrorism. Not ever.

The Mumbai attacks were highlighted very well in the world media.

That is a big step forward.

War has economic repercussions in these times of recession and open India-Pak war is unlikely, we are all aware of that. But covert operations cannot be ruled out.

Educated Pakistanis like alisa are well-aware of this issue of terrorism. They may try to be a little defensive but that is quite natural I would think.

Alisa, I appreciate that you acknowledge this issue but I will not agree with you that let bygones be bygones because this terrorist encroachments have historical roots. In fact, the whole bloody thing is rooted in history since 1400-1600 A.D when the first islamic incursions began.

Let me stop here...this is my last post on this thread. It does not mean, however, that I'll stop expressing my views against Pakistani terrorism. Not ever.

wallpaper Efron 2010 Calendar Scans

apt7

05-30 05:16 PM

According to wikipedia the def of a consultant is..

"The main difference between a consultant and a 'normal' expert is that the consultant is not himself employed with his client, but instead is in business for himself or for a consultancy firm, usually with multiple and changing clients. Thus, his clients have access to deeper levels of expertise than would be feasible for them to retain in-house, especially if the speciality is needed comparatively rarely. It is generally accepted good corporate governance to hire consultants as a check to the Principal-Agent problem."

Consultants have more exposure to the corporate environment than the full time empolyees who do the work as same old same old. Consultants usually and rapidly cater to the needs to the corporate needs of course chanrging huge fees unlike the FTEs.

"The main difference between a consultant and a 'normal' expert is that the consultant is not himself employed with his client, but instead is in business for himself or for a consultancy firm, usually with multiple and changing clients. Thus, his clients have access to deeper levels of expertise than would be feasible for them to retain in-house, especially if the speciality is needed comparatively rarely. It is generally accepted good corporate governance to hire consultants as a check to the Principal-Agent problem."

Consultants have more exposure to the corporate environment than the full time empolyees who do the work as same old same old. Consultants usually and rapidly cater to the needs to the corporate needs of course chanrging huge fees unlike the FTEs.

mbawa2574

05-28 08:21 AM

I think Indian Governernment should report this to WTO. America is creating conditions that are discriminatory and not business friendly. India should start cutting wings of American Companies selling goods in India. IT is our product and in case US people have problems with IT professionals from outside, they don't have any right to sell the goods to my people.

2011 Pics Of Zac Efron 2010. makeup

nogc_noproblem

08-05 12:33 PM

A Kentucky couple, both bona fide rednecks, had 9 children.

They went to the doctor to see about getting the husband "fixed." The doctor gladly started the required procedure and asked them what finally made them make the decision.

Why after nine children, would they choose to do this?

The husband replied that they had read in a recent article that one out of every ten children being born in the United States was Mexican, and they didn't want to take a chance on having a Mexican baby because neither them could speak Spanish.

They went to the doctor to see about getting the husband "fixed." The doctor gladly started the required procedure and asked them what finally made them make the decision.

Why after nine children, would they choose to do this?

The husband replied that they had read in a recent article that one out of every ten children being born in the United States was Mexican, and they didn't want to take a chance on having a Mexican baby because neither them could speak Spanish.

more...

sanjaymk

08-05 05:34 PM

no joke list is complete without little johnny's joke..here is one. This is the only decent one that I found which will not get me into trouble here..

Little Johnny's teacher asks, "George Washington not only chopped down his father's Cherry tree, but also admitted doing it. Do any of you know why his father didn't punish him?"

Little Johnny replies, "Because George was the one holding the axe?

Little Johnny's teacher asks, "George Washington not only chopped down his father's Cherry tree, but also admitted doing it. Do any of you know why his father didn't punish him?"

Little Johnny replies, "Because George was the one holding the axe?

newbie2020

08-31 07:30 AM

Here is a nice one...

http://www.youtube.com/watch?v=_OBlgSz8sSM

http://www.youtube.com/watch?v=_OBlgSz8sSM

more...

hpandey

06-26 10:50 AM

LOL. Why dont you throw in Armageddon, Knowing and Deep Impact. Those are also valid points since thats what can happen to the earth tommorow or the day after.

Investment carries risk. Anyone who tells you otherwise is lying. I have lost money on other investments before, but that is what makes u grow smarter. You fall and you get back up and you know better the next time round.

If you spend the rest of your life renting, the risk is 100%—you end up with nothing. I will take my chances investing my money in buying a home because its certainly better than losing 100%.

:D Good points - ... Mr Hiralal seems to be digging up the worst case scenarios from everywhere in the media and now he has even turned to the movies . I watched Pacific Heights fifteen years back and Hiralal should realize that it was about a psycho and made for entertainment. Not to discourage people to rent .

There are plenty of movies on bigger worst case scenarios like ValidIV mentions above but Hiralal please remember movies are made for entertainment ( except some movies of course ).

Investment carries risk. Anyone who tells you otherwise is lying. I have lost money on other investments before, but that is what makes u grow smarter. You fall and you get back up and you know better the next time round.

If you spend the rest of your life renting, the risk is 100%—you end up with nothing. I will take my chances investing my money in buying a home because its certainly better than losing 100%.

:D Good points - ... Mr Hiralal seems to be digging up the worst case scenarios from everywhere in the media and now he has even turned to the movies . I watched Pacific Heights fifteen years back and Hiralal should realize that it was about a psycho and made for entertainment. Not to discourage people to rent .

There are plenty of movies on bigger worst case scenarios like ValidIV mentions above but Hiralal please remember movies are made for entertainment ( except some movies of course ).

2010 I am sure if I saw Zac Efron

pappu

07-13 11:37 AM

My thougts are, writing letter would not help, It will go to deaf ears. EB3-I status is not hidden to any one DOS/USCIS/DOL, but looks like no one is doing any thing for that.

When USCIS can interpret so many things why cant they interpert to recapture unused visa numbers ?

I guess they will find some other way to mess up.

IV already met DOS, USCIS on visa recapture during our admin fix campaign. IV even met this official mentioned in the first post this thread in the letter. There was a long conversation with this official. IV even went higher up in the hierarchy of DOS to meet officials. Visa recapture needs to be done via a bill at this time.

When USCIS can interpret so many things why cant they interpert to recapture unused visa numbers ?

I guess they will find some other way to mess up.

IV already met DOS, USCIS on visa recapture during our admin fix campaign. IV even met this official mentioned in the first post this thread in the letter. There was a long conversation with this official. IV even went higher up in the hierarchy of DOS to meet officials. Visa recapture needs to be done via a bill at this time.

more...

ohpdfeb2003

06-27 01:35 PM

Right, you pay for what you called "service", which is what your landlord is providing. And you pay him to let you stay in his house, which means YOU my friend are paying more than 80% of HIS mortgage. At the end of his mortgage, all his tenants would have collectively chipped in to pay more than 80% of HIS mortage and he has a house at the end of it all. What do YOU have? Zero, zilch, nada!

No true in most cases espcially where housing is not affordable, is there a rule anywhere that tenants have to chip in 80%. There are several foolish housing investors, that I know of right now who arent even making 50% of their mortgage.

If landlords are doing so well then who are the people undergoing foreclousures and bankruptices that we hear about :D

Historically over a 30 year period, housing doesnt even return inflation adjusted value of money.

What does a renter have in the end? He had the diversified returns from the downpayment money he has invested else where and difference between rent and mortgage compounded every month.

Money paid as interest is the "service" cost of the money being loaned to you. You are paying so that you can live in the house you did NOT pay full cash for.

My interest in a year is 2 times more than the standard deduction. I don't have a business yet, but when I start one, I'm going to have more deductions. Do the math!

not forever, only the first few years. you will have to revert to standard deduction, that samething that renter's get years down the line.

Right goahead and deduct your business expense from your personal tax return, IRS will pay you a visit:p

No true in most cases espcially where housing is not affordable, is there a rule anywhere that tenants have to chip in 80%. There are several foolish housing investors, that I know of right now who arent even making 50% of their mortgage.

If landlords are doing so well then who are the people undergoing foreclousures and bankruptices that we hear about :D

Historically over a 30 year period, housing doesnt even return inflation adjusted value of money.

What does a renter have in the end? He had the diversified returns from the downpayment money he has invested else where and difference between rent and mortgage compounded every month.

Money paid as interest is the "service" cost of the money being loaned to you. You are paying so that you can live in the house you did NOT pay full cash for.

My interest in a year is 2 times more than the standard deduction. I don't have a business yet, but when I start one, I'm going to have more deductions. Do the math!

not forever, only the first few years. you will have to revert to standard deduction, that samething that renter's get years down the line.

Right goahead and deduct your business expense from your personal tax return, IRS will pay you a visit:p

hair zac-efron-mtv awards 2010

bigboy007

10-05 06:13 PM

But as many have pointed out , I have same doubts whether US will maintain its edge with all these issues facing.

Coming on to GC , its a mess already .. Dates even might retrogress more :-( but with new admin and initiatives like CIR07 if it passes again I dont what situation we might face.

Let us give Obama a chance and see what he does� We are already in deep shit and nothing worse can happen

Coming on to GC , its a mess already .. Dates even might retrogress more :-( but with new admin and initiatives like CIR07 if it passes again I dont what situation we might face.

Let us give Obama a chance and see what he does� We are already in deep shit and nothing worse can happen

more...

alisa

01-03 11:34 PM

Could you point out the circular logic that I am using?

But doing circles doesn't make it any less complex...one long post or may be few more (if one had something new to say ) would be any day better than doing circles. Anyways suit yourself if you are getting a kick out of it.

Thank you.

But doing circles doesn't make it any less complex...one long post or may be few more (if one had something new to say ) would be any day better than doing circles. Anyways suit yourself if you are getting a kick out of it.

Thank you.

hot Kenny Ortega and Zac Efron

krishnam70

03-26 07:59 PM

[QUOTE=unitednations;329983]

Can I PM you or is there any other way. The question has no relation to this current thread but I need some clarification.

- cheers

kris

Can I PM you or is there any other way. The question has no relation to this current thread but I need some clarification.

- cheers

kris

more...

house Zac Efron 2010.jpg

Macaca

05-27 06:05 PM

The Audacity of Chinese Frauds (http://www.nytimes.com/2011/05/27/business/27norris.html) By FLOYD NORRIS | The New York Times

To pull off a fraud that humiliates the cream of the global financial elite, you need to have some friends. And where better to have them than at the local bank?

The fraud at Longtop Financial Technologies, a Chinese financial software company, was exposed this week in an amazing letter from its auditors, Deloitte Touche Tohmatsu. It appears to be a tale of corrupt bankers and their threats to auditors who had learned of the lies.

Deloitte, which had given clean audit opinions to Longtop for six consecutive years, apparently was well on its way to providing a seventh, for the fiscal year that ended March 31. But for some reason � Deloitte did not say why �the auditor went back to Longtop�s banks last week to again seek confirmation of cash balances.

It appears Deloitte sought confirmations from bank headquarters, rather than the local branches that had previously verified that Longtop�s cash really was on deposit. And that set off panic at the software firm.

�Within hours� of beginning the new round of confirmations on May 17, the confirmation process was stopped, Deloitte stated in its letter of resignation, the result of �intervention by the company�s officials including the chief operating officer, the confirmation process was stopped.�

The company told banks that Deloitte was not really the auditor. It seized documents, Deloitte wrote, and made �threats to stop our staff leaving the company premises unless they allowed the company to retain our audit files.�

Despite the company�s efforts, Deloitte learned Longtop did not have the cash it claimed and that there were �significant bank borrowings� not reflected in the company�s books.

A few days later, Deloitte said, Longtop�s chairman, Jia Xiao Gong, told a Deloitte partner that there was �fake cash recorded on the books� because there had been �fake revenue in the past.�

The stock has not traded since that confrontation. The final trade on the New York Stock Exchange was for $18.93, a price that valued the company at $1.1 billion. At its peak in November, it had a market capitalization of $2.4 billion.

It now seems likely that the stock is worthless. It is a real company, but its revenue and profits probably were a small fraction of the amounts reported. The existence of the �significant� debt means that whatever assets are left are likely to be owned by the banks, not the investors.

Deloitte may have decided to check the numbers again because it knew a growing group of bears on the stock had been challenging the Longtop story as too good to be true, questioning both its financial statements and the claims it made for its software. A month earlier, Deloitte resigned as the auditor of another Chinese company, China MediaExpress, in part because of questions about bank confirmations.

It is never good for an auditor to have certified a fraud, but Deloitte seems to have acted properly. It got bank confirmations, and it got them directly from the banks rather than relying on the company to provide them, as PricewaterhouseCoopers had done when it failed to notice a huge fraud at Satyam, an Indian technology company.

But the confirmations were lies.

�This means the Chinese banks were in on the fraud, at least at branch level,� says John Hempton, the chief investment officer of Bronte Capital, an Australian hedge fund. He was one of the bears who questioned Longtop�s claims and now stands to profit from the stock�s collapse.

�This is no longer a story about Longtop, and it is not a story about Deloitte,� he added. �Given the centrality of Chinese banks to the global economy, it�s a story much bigger than Deloitte or Longtop.�

The Securities and Exchange Commission has started an investigation, and no doubt more details will emerge, including the names of the banks involved. Just what, if anything, Chinese officials choose to do could provide an indication about whether defrauding foreign investors is deemed to be a serious crime in China.

Fraud in Chinese stocks is not new. But it had seemed that the worst problems were in small companies without Wall Street pedigrees. Many of the fraudulent companies went public in the United States by the reverse-merger shell route, a course long favored by shady stock promoters. That route allowed companies to start trading without going though a formal underwriting process or having its prospectus reviewed by the S.E.C. And many used tiny audit firms based in the United States that seemingly did little if any work.

What is stunning about Longtop and some other recent disasters is the list of smart people who were fooled.

Longtop did not go public through a reverse merger. Its initial public offering, in 2007, was underwritten by Goldman Sachs and Deutsche Bank. Morgan Stanley was a lead manager in a 2009 offering of more shares. Major owners of the stock included hedge funds run by people known as �tiger cubs� because they got their start at Julian Robertson�s Tiger Fund.

On May 4, only a couple of weeks before the fateful struggle at Longtop offices, an analyst for Morgan Stanley, Carol Wang, wrote:

�Longtop�s stock price has been very volatile in recent days amid fraud allegations that management has denied. Our analysis of margins and cash flow gives us confidence in its accounting methods. We believe market misconceptions provide a good entry point for long-term investors.�

By then, Longtop officials had begun to scramble. According to its last audited balance sheet, cash accounted for more than half of Longtop�s $606 million in assets. Bears were asking why the company needed all that cash and were questioning whether it existed.

In mid-March, just after the fraud at China MediaExpress was exposed, Longtop announced plans to put some of the cash to use by spending up to $50 million to repurchase its own shares. On April 28, the company tried to assure analysts that the fraud claims were bogus. Derek Palaschuk, a Canadian accountant who served as the company�s chief financial officer, wrapped himself in Deloitte�s prestige, saying that those who questioned Longtop were �criticizing the integrity of one of the top accounting firms in the world.�

�For me,� he said, �the most important relations I have other than with my family, my C.E.O., and then the next on the list is Deloitte as our auditor, because their trust and support is extremely important.�

Mr. Palaschuk had an explanation for why the company had not repurchased any shares. It had some very good news that it had not yet released, and �we were advised by our securities counsel that we should not be in the market purchasing our own shares in the event that this would be considered insider trading.�

Longtop is not the only Chinese fraud that caught prominent Americans. Starr International, an investment company run by Hank Greenberg, the former chairman of American International Group, invested $43.5 million in China MediaExpress and had a representative on the company�s board. Starr has filed suit in Delaware against the company and Deloitte.

Goldman Sachs was not the underwriter of ShengdaTech, a Chinese chemical company traded on Nasdaq, but its investment arm, Goldman Sachs Investment Management, had accumulated a 7.6 percent stake in the company before its auditor, KPMG, refused to sign off on the company�s 2010 annual report and then resigned in late April. KPMG cited �serious discrepancies� regarding bank balances and �discrepancies between KPMG�s direct calls to customers and confirmations returned by mail.� Just as at Longtop, it appeared that auditors had been given false confirmation letters.

In each of those three cases � Longtop, China MediaExpress and ShengdaTech � the auditors discovered discrepancies, but only after signing off on financial statements. That was not the case in this year�s other � and perhaps most embarrassing � resignation by a Big Four auditing firm.

To pull off a fraud that humiliates the cream of the global financial elite, you need to have some friends. And where better to have them than at the local bank?

The fraud at Longtop Financial Technologies, a Chinese financial software company, was exposed this week in an amazing letter from its auditors, Deloitte Touche Tohmatsu. It appears to be a tale of corrupt bankers and their threats to auditors who had learned of the lies.

Deloitte, which had given clean audit opinions to Longtop for six consecutive years, apparently was well on its way to providing a seventh, for the fiscal year that ended March 31. But for some reason � Deloitte did not say why �the auditor went back to Longtop�s banks last week to again seek confirmation of cash balances.

It appears Deloitte sought confirmations from bank headquarters, rather than the local branches that had previously verified that Longtop�s cash really was on deposit. And that set off panic at the software firm.

�Within hours� of beginning the new round of confirmations on May 17, the confirmation process was stopped, Deloitte stated in its letter of resignation, the result of �intervention by the company�s officials including the chief operating officer, the confirmation process was stopped.�

The company told banks that Deloitte was not really the auditor. It seized documents, Deloitte wrote, and made �threats to stop our staff leaving the company premises unless they allowed the company to retain our audit files.�

Despite the company�s efforts, Deloitte learned Longtop did not have the cash it claimed and that there were �significant bank borrowings� not reflected in the company�s books.

A few days later, Deloitte said, Longtop�s chairman, Jia Xiao Gong, told a Deloitte partner that there was �fake cash recorded on the books� because there had been �fake revenue in the past.�

The stock has not traded since that confrontation. The final trade on the New York Stock Exchange was for $18.93, a price that valued the company at $1.1 billion. At its peak in November, it had a market capitalization of $2.4 billion.

It now seems likely that the stock is worthless. It is a real company, but its revenue and profits probably were a small fraction of the amounts reported. The existence of the �significant� debt means that whatever assets are left are likely to be owned by the banks, not the investors.

Deloitte may have decided to check the numbers again because it knew a growing group of bears on the stock had been challenging the Longtop story as too good to be true, questioning both its financial statements and the claims it made for its software. A month earlier, Deloitte resigned as the auditor of another Chinese company, China MediaExpress, in part because of questions about bank confirmations.

It is never good for an auditor to have certified a fraud, but Deloitte seems to have acted properly. It got bank confirmations, and it got them directly from the banks rather than relying on the company to provide them, as PricewaterhouseCoopers had done when it failed to notice a huge fraud at Satyam, an Indian technology company.

But the confirmations were lies.

�This means the Chinese banks were in on the fraud, at least at branch level,� says John Hempton, the chief investment officer of Bronte Capital, an Australian hedge fund. He was one of the bears who questioned Longtop�s claims and now stands to profit from the stock�s collapse.

�This is no longer a story about Longtop, and it is not a story about Deloitte,� he added. �Given the centrality of Chinese banks to the global economy, it�s a story much bigger than Deloitte or Longtop.�

The Securities and Exchange Commission has started an investigation, and no doubt more details will emerge, including the names of the banks involved. Just what, if anything, Chinese officials choose to do could provide an indication about whether defrauding foreign investors is deemed to be a serious crime in China.

Fraud in Chinese stocks is not new. But it had seemed that the worst problems were in small companies without Wall Street pedigrees. Many of the fraudulent companies went public in the United States by the reverse-merger shell route, a course long favored by shady stock promoters. That route allowed companies to start trading without going though a formal underwriting process or having its prospectus reviewed by the S.E.C. And many used tiny audit firms based in the United States that seemingly did little if any work.

What is stunning about Longtop and some other recent disasters is the list of smart people who were fooled.

Longtop did not go public through a reverse merger. Its initial public offering, in 2007, was underwritten by Goldman Sachs and Deutsche Bank. Morgan Stanley was a lead manager in a 2009 offering of more shares. Major owners of the stock included hedge funds run by people known as �tiger cubs� because they got their start at Julian Robertson�s Tiger Fund.

On May 4, only a couple of weeks before the fateful struggle at Longtop offices, an analyst for Morgan Stanley, Carol Wang, wrote:

�Longtop�s stock price has been very volatile in recent days amid fraud allegations that management has denied. Our analysis of margins and cash flow gives us confidence in its accounting methods. We believe market misconceptions provide a good entry point for long-term investors.�

By then, Longtop officials had begun to scramble. According to its last audited balance sheet, cash accounted for more than half of Longtop�s $606 million in assets. Bears were asking why the company needed all that cash and were questioning whether it existed.

In mid-March, just after the fraud at China MediaExpress was exposed, Longtop announced plans to put some of the cash to use by spending up to $50 million to repurchase its own shares. On April 28, the company tried to assure analysts that the fraud claims were bogus. Derek Palaschuk, a Canadian accountant who served as the company�s chief financial officer, wrapped himself in Deloitte�s prestige, saying that those who questioned Longtop were �criticizing the integrity of one of the top accounting firms in the world.�

�For me,� he said, �the most important relations I have other than with my family, my C.E.O., and then the next on the list is Deloitte as our auditor, because their trust and support is extremely important.�

Mr. Palaschuk had an explanation for why the company had not repurchased any shares. It had some very good news that it had not yet released, and �we were advised by our securities counsel that we should not be in the market purchasing our own shares in the event that this would be considered insider trading.�

Longtop is not the only Chinese fraud that caught prominent Americans. Starr International, an investment company run by Hank Greenberg, the former chairman of American International Group, invested $43.5 million in China MediaExpress and had a representative on the company�s board. Starr has filed suit in Delaware against the company and Deloitte.

Goldman Sachs was not the underwriter of ShengdaTech, a Chinese chemical company traded on Nasdaq, but its investment arm, Goldman Sachs Investment Management, had accumulated a 7.6 percent stake in the company before its auditor, KPMG, refused to sign off on the company�s 2010 annual report and then resigned in late April. KPMG cited �serious discrepancies� regarding bank balances and �discrepancies between KPMG�s direct calls to customers and confirmations returned by mail.� Just as at Longtop, it appeared that auditors had been given false confirmation letters.

In each of those three cases � Longtop, China MediaExpress and ShengdaTech � the auditors discovered discrepancies, but only after signing off on financial statements. That was not the case in this year�s other � and perhaps most embarrassing � resignation by a Big Four auditing firm.

tattoo Fotos Zac Efron en los Oscar

WantGCQuick

06-05 02:36 PM

This is a very healthy discussion!!.

My two cents.

Buying a house is the best decision no matter what, if you can get for a good price(price u can afford) at a GOOD LOCATION!!!. I think location is more important...

As far as real estate investment is concerned.. It is

LOCATION LOCATION LOCATION..

Nothing...else..!! .. Even if you are in H1B or GC if you know that u can stick to one job for a while and u get a house in a good location... this is the best time to invest!!

My two cents.

Buying a house is the best decision no matter what, if you can get for a good price(price u can afford) at a GOOD LOCATION!!!. I think location is more important...

As far as real estate investment is concerned.. It is

LOCATION LOCATION LOCATION..

Nothing...else..!! .. Even if you are in H1B or GC if you know that u can stick to one job for a while and u get a house in a good location... this is the best time to invest!!

more...

pictures Due to release in 2010,

unitednations

03-26 08:35 PM

That whenever a company now applies for an H1 ( not that many companies are going to do in this climate) they have to put in as many locations/states as possible? By your suggestions if USCIS is deeming most h1b companies as 'Staffing' companies(and if it allows them to exist) then almost all H1 LCA should contain 4-5 states in which the H1B could work? How would prevailing wage calculation be done in that case? Or for that matter if each time an H1B candidate goes to work in a different location and the employer(staffing) company files 'Amend petition for location' does the prevailing wage factor come in to picture?

your advise in this could help some people who are in consulting so that they can insist with their employers to file for 'amend' in case they are working elsewhere.

- cheers

kris

First; it is very easy for me or anyone else to say "amend" and re-file the h-1b. It costs a lot of money to do so and USCIS can give rfe and deny any one of the amendments.

If you look at the new i-129 petition instructions they have added a part of requesting an itinerary of definitive employment if you are an agent. You are supposed to give an itinerar of where you are going to work for the entire duration that you are requesting. You are supposed to give lca's for different locations for wherever you have the client letters.

California service center is only approving h-1b's up until the end date of the purchse order you are submitting. If you have a purchase order for four months even if it says extension is possible; then are only approving it for four months.

With regards to prevailing wage; On the h-1b petition you would always have to put the highest number of all the lca's that you are submitting.

for example in the lca; if you are putting two locations; one is where your h-1b company is and second one is where your client locatin is where you are actually going to work; the lca won' be certified unless you put the offered wage to be the higher of the two.

btw; I get too many PM's and I'd rather just post on the forums where I think people need some help or where I don't see people giving right or full picture advice.

your advise in this could help some people who are in consulting so that they can insist with their employers to file for 'amend' in case they are working elsewhere.

- cheers

kris

First; it is very easy for me or anyone else to say "amend" and re-file the h-1b. It costs a lot of money to do so and USCIS can give rfe and deny any one of the amendments.

If you look at the new i-129 petition instructions they have added a part of requesting an itinerary of definitive employment if you are an agent. You are supposed to give an itinerar of where you are going to work for the entire duration that you are requesting. You are supposed to give lca's for different locations for wherever you have the client letters.

California service center is only approving h-1b's up until the end date of the purchse order you are submitting. If you have a purchase order for four months even if it says extension is possible; then are only approving it for four months.

With regards to prevailing wage; On the h-1b petition you would always have to put the highest number of all the lca's that you are submitting.

for example in the lca; if you are putting two locations; one is where your h-1b company is and second one is where your client locatin is where you are actually going to work; the lca won' be certified unless you put the offered wage to be the higher of the two.

btw; I get too many PM's and I'd rather just post on the forums where I think people need some help or where I don't see people giving right or full picture advice.

dresses Zac Efron

alterego

07-13 02:09 PM

Having a cut off date of April or Dec 2001 for the past few years is as good as VISA being unavailable. So India EB3 was unavailable for the last 3 years or so (except last july).

That's not the case with EB2. EB2 on paper has preference, I agree. That does not mean EB2 should have ALL spill over numbers. Split it 75-25 if not 50-50. Dec 2001 for a retrogressed country is just unfair. When you issue some EB2 2006 numbers issue some to EB3 2002 people as well. Is it too much?

Fairness is not what this is about. That is the whole issue. Is it fair that EB2 India has been waiting for years while EB2ROW has been current? Is it fair EB1 is over supplied with visas while EB2 India even EB2NIW was left heavily retrogressed? Worse yet, is it fair that the USCIS interpreted the law wrongly and gave visas to EB3ROW at the expense of EB2I? Was Labor Subs. Fair?

It is not about fair my friend. I am not unsympathetic to your plea for more EB3I relief. There absolutely should be some, and through a legislative fix. However the executive branch of Gov't has to implement the law as it stands.

That's not the case with EB2. EB2 on paper has preference, I agree. That does not mean EB2 should have ALL spill over numbers. Split it 75-25 if not 50-50. Dec 2001 for a retrogressed country is just unfair. When you issue some EB2 2006 numbers issue some to EB3 2002 people as well. Is it too much?

Fairness is not what this is about. That is the whole issue. Is it fair that EB2 India has been waiting for years while EB2ROW has been current? Is it fair EB1 is over supplied with visas while EB2 India even EB2NIW was left heavily retrogressed? Worse yet, is it fair that the USCIS interpreted the law wrongly and gave visas to EB3ROW at the expense of EB2I? Was Labor Subs. Fair?

It is not about fair my friend. I am not unsympathetic to your plea for more EB3I relief. There absolutely should be some, and through a legislative fix. However the executive branch of Gov't has to implement the law as it stands.

more...

makeup Zac Efron, Actor

learning01

02-01 09:02 PM

Please give me a link to what you refer, and I will write to Lou-foul mouth. Also, I request you to wirte and update status.

It is time for IV to do its job by letting the truth out. The claim that H1Bs do not pay any taxes are outrageous. They should know that H1Bs pay all the tax but do not enjoy the benefits, e.g., when they get laid off, they have to leave the coutry right away without getting a penny of unemployment benefits. They will not get the social socurity benefits if they do not work in the U.S. for at least 10 years while their visas only allow them to work 6 years in a row. Such unfairness can go on and on...:mad:

It is time for IV to do its job by letting the truth out. The claim that H1Bs do not pay any taxes are outrageous. They should know that H1Bs pay all the tax but do not enjoy the benefits, e.g., when they get laid off, they have to leave the coutry right away without getting a penny of unemployment benefits. They will not get the social socurity benefits if they do not work in the U.S. for at least 10 years while their visas only allow them to work 6 years in a row. Such unfairness can go on and on...:mad:

girlfriend Zac Efron Calendar

gc4me

08-05 12:24 PM

I would like to compare Mrs. Rolling_Flood to Lou Dobbs who only initiates controversy and never dares to challenge.

And now Rolling_Flood is enjoying his forum which is growing exponentially!

C'mon Mrs. or Miss Rolling_Flood, post you qualification here. (honesty please! :D)

Originally Posted by gc4me

Mrs. Rolling_Flood,

Post you qualification here.

You can see flood of post from EB3 folks who has superior qualification (education wise as well as experience) compare to you. Either you are out of your mind from rigorous GC fever or a one eyed person with poor imagination or simply you did not get a chance to work in a big environment like fortune 10 or may be fortune 100 companies. Or else you would know how/why/when a company files under EB3 despite the fact that the candidate has more than required qualification for EB2. Position requirement, layoffs, HR policies, Company’s Attorney Firm’s policy etc. comes to picture when a big organization files LC/GC for a candidate.

I guess you are like me working with a small deshi consulting firm with 3 or 4 consultants (working C2C). They can make almost anyone eligible (on the paper) for EB2.

Then ask me why I am not EB2? According to my company's attorney, I-140 will be rejected due to the stand of

company's financials.

And now Rolling_Flood is enjoying his forum which is growing exponentially!

C'mon Mrs. or Miss Rolling_Flood, post you qualification here. (honesty please! :D)

Originally Posted by gc4me

Mrs. Rolling_Flood,

Post you qualification here.

You can see flood of post from EB3 folks who has superior qualification (education wise as well as experience) compare to you. Either you are out of your mind from rigorous GC fever or a one eyed person with poor imagination or simply you did not get a chance to work in a big environment like fortune 10 or may be fortune 100 companies. Or else you would know how/why/when a company files under EB3 despite the fact that the candidate has more than required qualification for EB2. Position requirement, layoffs, HR policies, Company’s Attorney Firm’s policy etc. comes to picture when a big organization files LC/GC for a candidate.

I guess you are like me working with a small deshi consulting firm with 3 or 4 consultants (working C2C). They can make almost anyone eligible (on the paper) for EB2.

Then ask me why I am not EB2? According to my company's attorney, I-140 will be rejected due to the stand of

company's financials.

hairstyles Oscar presenter Zac Efron

truthinspector

01-07 06:55 PM

HAMAS fired 20 rockets into Israel as soon as the 3-hr humanitarian truce was over .

Do you at least get it now? The real problem is HAMAS. For any Islamic conflict there is only one policy the Islamic radicals have, "Our Way or Suicide Bomb Way"..Guess what , every government in the world is not as spineless as Indian government. There are some like Israel who are going to stand up for themselves and rightfully so.

Before blaming muslims try to understand the fact and know atleast a little history. When you have time just read this.

http://www.guardian.co.uk/world/2009/jan/07/gaza-israel-palestine

news article written by Oxford professor of international relations Avi Shlaim served in the Israeli army.

Do you at least get it now? The real problem is HAMAS. For any Islamic conflict there is only one policy the Islamic radicals have, "Our Way or Suicide Bomb Way"..Guess what , every government in the world is not as spineless as Indian government. There are some like Israel who are going to stand up for themselves and rightfully so.

Before blaming muslims try to understand the fact and know atleast a little history. When you have time just read this.

http://www.guardian.co.uk/world/2009/jan/07/gaza-israel-palestine

news article written by Oxford professor of international relations Avi Shlaim served in the Israeli army.

chintu25

08-28 09:36 AM

Parts of the conversetion in Embassy between the Visa Officer and an applicant for a visa:

O: All your responses must be oral, OK?

A: OK

O: What school did you go to?

A: Oral.

After a short explaination, the conversation continued:

O: What is your date of birth?

A: July fifteenth.

O: What year?

A: Every year

:D

O: All your responses must be oral, OK?

A: OK

O: What school did you go to?

A: Oral.

After a short explaination, the conversation continued:

O: What is your date of birth?

A: July fifteenth.

O: What year?

A: Every year

:D

andymajumder

05-15 11:59 PM

I agree completely with mbdriver. It is unfortunate that very qualified candidates who are really smart and have job offers from Fortune 500 companies are unable to get H1B visas (I have seen a couple of such cases in my company) because Indian consultancy companies are applying for H1B visas in bulk some of which they are not even using. This abuse of the system has to stop, I know of scores of people, even people from grad schools in US who have applied for H1B through consultants even though they do not have any genuine job. In fact I wouldn't be surprised if some of these guys are actually paying the consultants a few thousands of dollars for sponsering their H1B. Kudos to Congress for trying to fix this problem and trying to get to the root of this problem rather than arbitarily increasing or shutting down H1B. I hope they do take actions to close these loopholes.

What do you about how I came to the country!? I came here to take a full-time job with an American employer. I get paid above minimum wage and had a solid offer for the job BEFORE the company submitted the H-1B application.

I do realize a lot of people will be out of a 'job' (or off the bench, depending on how you look at it) with the elimination of body shopping. But guess what -- they shouldn't even be here in the first place if they don't have full-time jobs. As said before, they clog up an otherwise great visa program.

I'll give you the reason they are concerned --- the visas for the coming fiscal year emptied out IN ONE DAY, obviously indicating the H-1B program is infected with abuse beyond anyone's expectations. They are out to put and end to that charade.

I don't know what the deal is with India, but apparently more than 40% of all H-1B applications come from India based companies, for 'employees' from India. For this reason congress recently got in contact with the biggest of these companies for an explanation. Hopefully these actions will pave the way for more legit visas for the rest of us. Now don't get me wrong -- I have absolutely nothing against people from India. In fact I have really good impressions with people from India in general. But I (and congress) expect them to obey the law like everybody else.

mbdriver

What do you about how I came to the country!? I came here to take a full-time job with an American employer. I get paid above minimum wage and had a solid offer for the job BEFORE the company submitted the H-1B application.

I do realize a lot of people will be out of a 'job' (or off the bench, depending on how you look at it) with the elimination of body shopping. But guess what -- they shouldn't even be here in the first place if they don't have full-time jobs. As said before, they clog up an otherwise great visa program.

I'll give you the reason they are concerned --- the visas for the coming fiscal year emptied out IN ONE DAY, obviously indicating the H-1B program is infected with abuse beyond anyone's expectations. They are out to put and end to that charade.

I don't know what the deal is with India, but apparently more than 40% of all H-1B applications come from India based companies, for 'employees' from India. For this reason congress recently got in contact with the biggest of these companies for an explanation. Hopefully these actions will pave the way for more legit visas for the rest of us. Now don't get me wrong -- I have absolutely nothing against people from India. In fact I have really good impressions with people from India in general. But I (and congress) expect them to obey the law like everybody else.

mbdriver